Loyalty is a virtue. But will blind loyalty waste your savings?

New research conducted by iSelect as part of the Pulse of Health 2024 survey found that Australian women have been with their current healthcare provider for an average of 8.2 years.

To put it in perspective, eight years ago, Malcolm Turnbull was our Prime Minister. The average cost of petrol is $1.10 per liter and we are witnessing the UK’s referendum on leaving the European Union. It’s fair to say that a lot has changed in eight years.

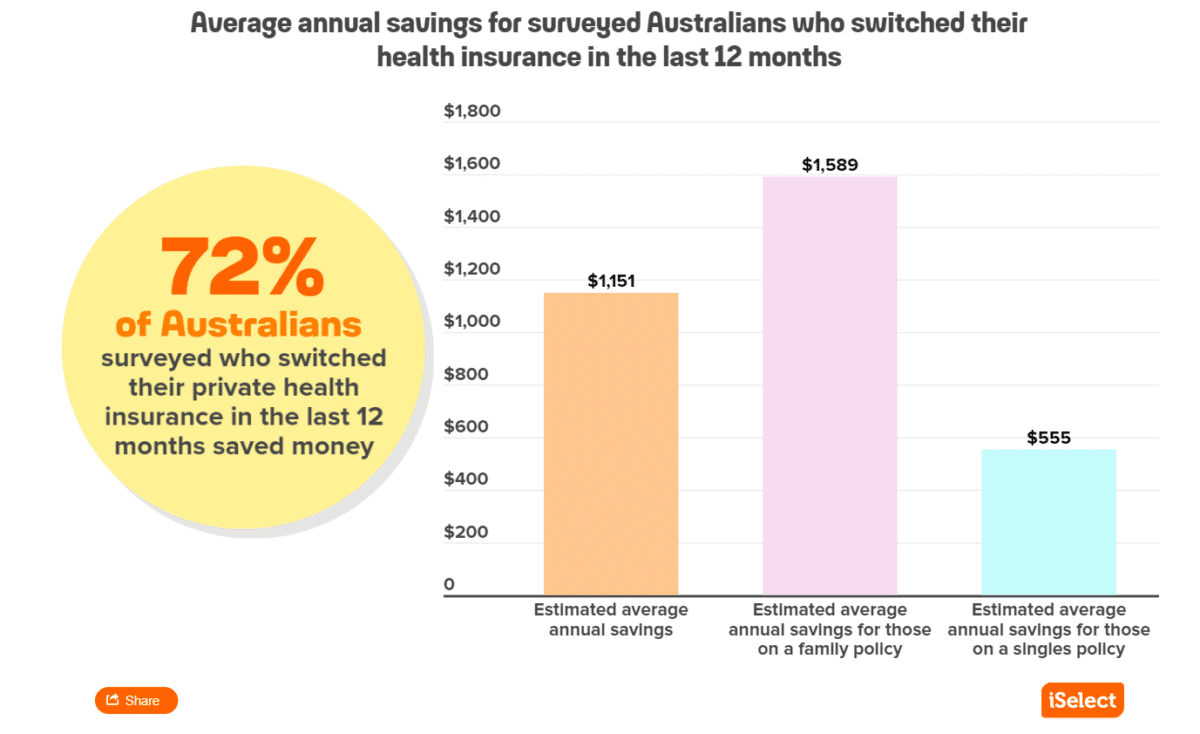

While there’s nothing wrong with sticking to a good thing — proper health insurance, no doubt — there can be consequences, including financial ones, of setting and forgetting. I get it; we’re all busy. The idea of taking time out of your day to check on your health insurance may seem like more effort than it’s worth. Until you realize that iSelect’s survey also found that 72% of people who switched health insurance in the past 12 months saved money. The average annual savings is a satisfying $1,151.

Why do women stick with the same private health insurance company?

With children, work and life management all front and center in our brains, it’s understandable that Australian women can only think about their health insurance long enough to cover the costs. Loyalty to a health insurance company may simply stem from not having enough time to find an option that better suits them (and their families).

What do Australian women look for in health insurance?

When asked why they chose to switch health insurance, Australians surveyed had two main reasons: they wanted better value and cheaper deals. These are incredibly understandable and relevant motivations given that there seems to be no end in sight to the cost of living crisis. But what does better value actually mean?

Well, for the Australian women surveyed, there was clear consensus that three additional factors were the most important. More than half of the women surveyed prioritized general dental, vision and major dental insurance. Medicare typically doesn’t cover these services, so people often turn to private health insurance to help pay some of the expensive bills.

These services are of particular interest to women in family policy.

Dental disease can have a wide-ranging impact on a child’s current and future health and well-being. Unfortunately, children aged five to nine have the dubious distinction of having the highest rates of potentially preventable hospitalizations for dental disease compared to other age groups in Australia.

Interestingly, we’ve all heard of at least one child whose bad behavior or lack of interest in class was suddenly corrected by putting on a pair of glasses and being able to see the whiteboard.

So, how much money can women expect to save by switching to health insurance?

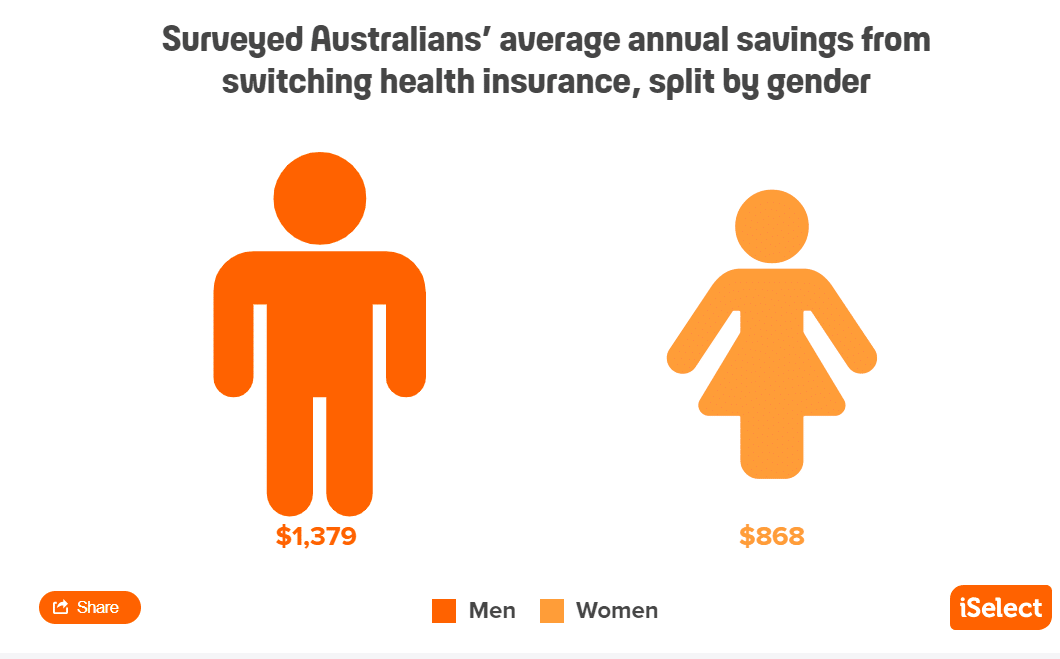

While the Health Pulse survey did show Australians saved an average of $1,151, the figures by gender were not quite the same.

Women save an average of just $869, while men save an average of $1,379.

Importantly, health insurance is community rated. This means that, unlike other types of insurance, gender does not affect premiums. Women and men pay the same premiums for the same policies.

So why is there a difference in savings? Andres Gutierrez, iSelect’s general manager of health, said it may depend on the coverage options for different genders.

“If women want a policy that covers pregnancy so that they can choose their own obstetrician and give birth in a private hospital, then they usually need to choose a gold-level hospital policy. Obviously, gold is the most important and provides the greatest protection, It also tends to have a higher premium,” he said.

“While this gold-level policy will certainly help when you’re looking to start or expand your family, it may also bring unnecessary coverage if you don’t plan on having children in the near future.”

Of course, no one is going to be mad at getting an extra $869 a year, but is that the best a woman can hope for? not necessarily. Looking at the data from a household policy perspective suggests that more savings are likely.

According to those surveyed Switch health insurance They saved an average of $1,589 per year on their home policy over the past 12 months.

Even how Australians make the switch appears to affect their expected annual savings. People who choose to use the comparison service save an additional $200 on average.

How to save money by switching health insurance?

Everyone’s health needs are different. Therefore, our health insurance requirements vary. While one person may need minimal coverage, another may need more covered services. These differences can cause health insurance premiums to vary widely. However, there are still some tips that everyone can follow to become a savvy health insurance switcher.

Select only the cover you need

When considering health insurance, it’s probably a good idea to stick to the basics as much as possible. Of course, it may be tempting to get as much coverage as possible, but it may not be necessary for you at this moment. In the future, your health needs may change (and they probably will!), and you can adjust your coverage at any time. This way, you avoid paying for something you don’t actually need.

It’s worth taking the time to think carefully about what you will need (or expect to need) over the next year or two. Maybe this is the year you finally get back to the dentist? If so, additional services including dental may appear on the card. Or, you may be considering expanding your family in the next few years. In this case, hospital insurance covering pregnancy may become a priority.

Check your health insurance regularly

Loyalty can lead to too many women paying more for health insurance than they need, so don’t let that happen to you.

Taking the time to regularly re-evaluate your health insurance, including your coverage and what you’ve been using, can help you get value and save money. Remember, what you needed last year or the year before may not be what you need now.

If you’re worried about not having enough time or bandwidth to thoroughly review your policy, a comparison service can help. They can quickly help you compare a range of policies from different insurance companies to see if there are other better options for you.

Consider the value of insuring your child

While a family or single-parent policy may mean higher premiums than a “single” policy, it does mean you can take care of your children’s health, too. Also, keep in mind that children are generally free to cover up until they reach a certain age.

It can be a balance between the premium you pay and the value you receive. It may be worth spending a little extra each month to look after your and your child’s well-being.

Is it time to find out how much money you can save on health insurance?

What remains is blind loyalty to fairy tales. Taking the time to really take a look at your health insurance — and what else — might be the way you take back some power over the cost-of-living crisis and find some wiggle room in your budget.